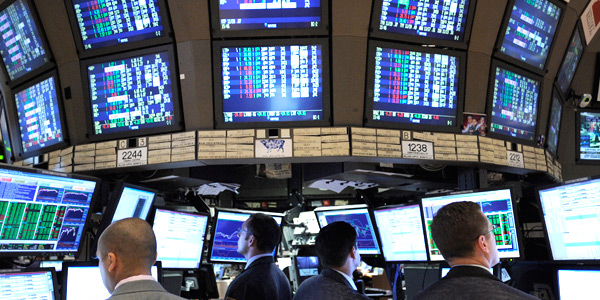

The main US stock indexes closed on Tuesday with a significant drop, which was facilitated by the release of unexpectedly weak housing market data. The Dow Jones fell by 2.6%, the S&P 500 by 2% and the NASDAQ by 2.5%.

According to the data published yesterday, the number of purchase and sale transactions on the secondary housing market declined by 0.7% compared to December contrary to expectations of growth - analysts had forecasted an increase of the index by 2%.

In Europe, macrostatistics was more optimistic, however, according to the senior market analyst IG Joshua Mahoney, which reports France-Presse, it put pressure on the indices, increasing the concerns of players about possible tightening of monetary policy by central banks. Major European indices closed with a decline of 0.52%.

The withdrawal of players from the risk was also related to the upcoming publication of the Federal Reserve meeting minutes, expected this evening.