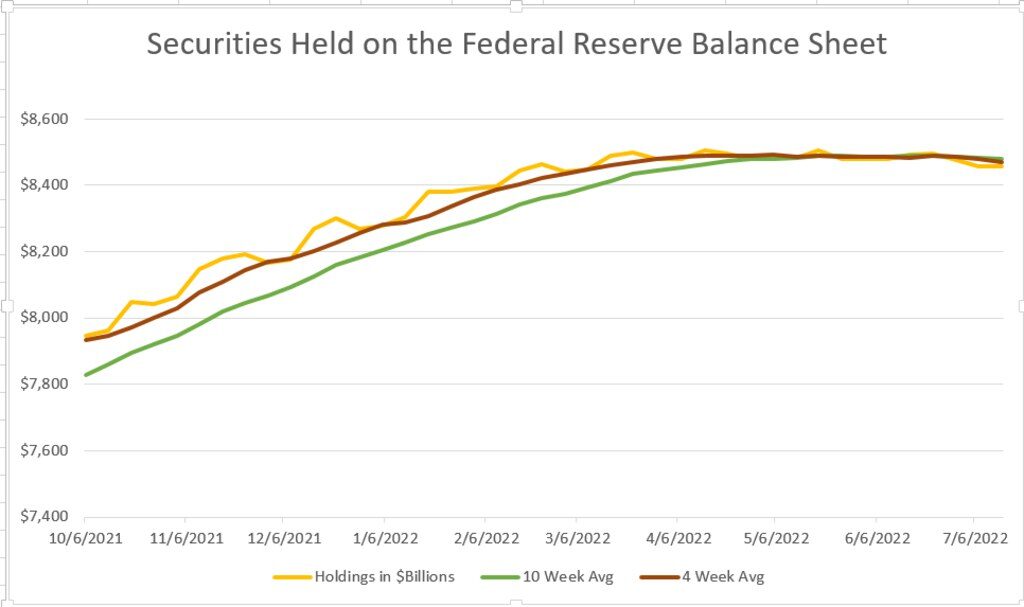

The Fed has indeed begun to reduce the size of the securities held on its balance sheet by $47.5 billion per month. They do this by opting not to reinvest all the proceeds of maturing Treasury debt that they hold. We can see from the graph below that its effect on the absolute size of the balance sheet is quite minimal. Even when increased to a promised $95 billion per month in September, it will still be a relatively glacial pace of shrinkage relative to the pace at which the balance sheet grew during the two-year period starting in March 2020.

While we see that the balance sheet has plateaued and has begun to decline modestly in recent weeks – and the moving averages have begun to turn lower – it will clearly take a few months just for the size of the Fed’s securities holdings to revert to their size from the start of the year.

In 2018, the Fed began shrinking its balance sheet and raising rates to fight inflation (purple line) and to give itself more ammunition if a crisis developed. We had a bear market in late 2018 as both effects kicked in, though stocks stopped falling when the Fed announced that its December 2018 hike would be its last. Stocks ignored the shrinking balance sheet for much of 2019, and then kicked into high gear when the roughly $600 billion drop in the size of the balance sheet led to a repo crisis among major banks. Stocks eventually jumped when the Fed responded by reversing its balance sheet reduction, a jump that was only halted – albeit temporarily – by the Covid crisis.

The evidence for stock traders is this: major equity indices have shown that they are able to largely ignore QT. But the bouts of QT have been fleeting, and the scope of QE that is subject to reversal has never been larger. Nor has the level of inflation been higher in over 20 years. So far investors can focus on rate hikes instead of QT, but QT remains a potential stumbling block later this year, when it kicks in during a seasonally difficult period that includes the mid-term elections.