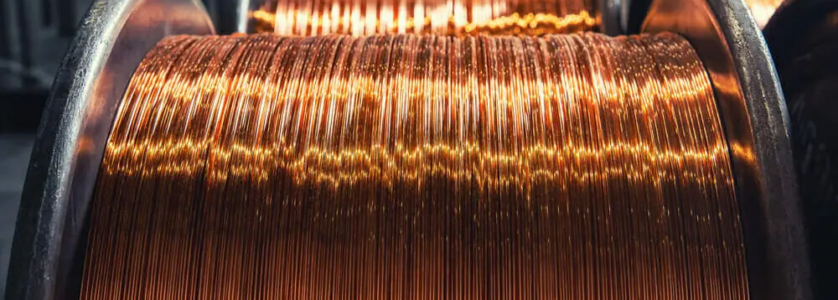

Copper prices fell to their lowest since November 2022, breaking through

$8,000 a tonne. The reason was the situation in China, its largest

importer - the pace of its economic recovery was

China, its biggest importer, is recovering at a slower pace than analysts and investors expected, reports

profinance.ru. China consumes about 50% of the world's copper.

The negative factor was the weak macrostatistics for April,

published on Wednesday. As noted by Citigroup, it is alarming,

because it shows that the real results of the country

are quite modest. That factor has caused a significant

decline in metal prices in recent weeks. However, according to

Goldman Sachs, if players stop fearing a global recession,

they will shoot up, and copper will rise to $10,000 a tonne by May

next year. The bank is known for its bullish outlook on it.

At the moment, copper supply exceeds demand, and since

is likely to further increase its volume in the global market, prices

are declining, said the head of trading at Yonggang